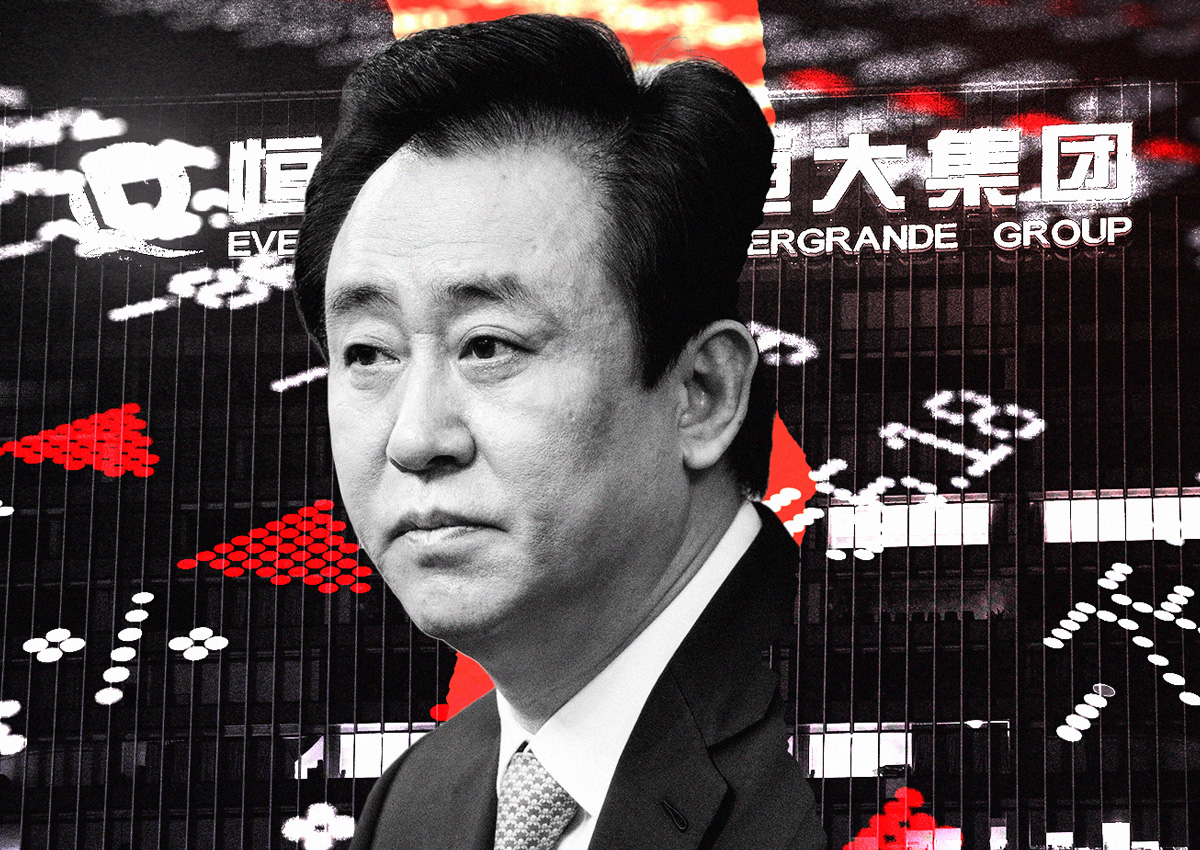

If every person on the planet loses $10, that’s still nothing compared to what Chinese real estate giant Evergrande Group will suffer in 2021-2022.

The struggling developer recently disclosed an $81 billion loss over two years, according to The Washington Post. report. The disclosure comes amid the company’s repeatedly delayed earnings report.

In 2022, the company’s liabilities will reach $335 billion. That dwarfs $251 billion in assets and does little to allay concerns that financial difficulties at one of China’s largest apartment builders could affect the rest of the country’s economy.

Evergrande has become the world’s most indebted developer as losses piled up two years ago. The company first reported liabilities of more than $300 billion in June 2021 and fell into default six months later.

Evergrande has since pursued quixotic attempts to restructure some of its debt. The company announced a restructuring plan several months ago but is still negotiating its debt with overseas investors.

Prism, the company’s external auditor, declined to comment on the financial report because it could not obtain sufficient evidence that Evergrande would be able to meet its obligations. In addition, the Hong Kong Stock Exchange has suspended trading in shares since March last year, approaching the deadline for the company’s complete delisting.

Chief executive Xia Haijun and chief financial officer Pan Darong resigned a year ago. New York Times. After that, they were replaced by Xiao Xiao En and Qian Cheng respectively.

Another struggling Chinese developer is Kaisa, which previously defaulted on a $400 million bond repayment. The companies’ dire woes are notable because of the outsized influence of real estate in China — the sector accounts for a quarter of China’s economic growth.

— holden walter warner