Despite an overall slowdown in real estate sales, taxable real estate values in Miami-Dade County have increased by $48 billion this year amid a surge in development.

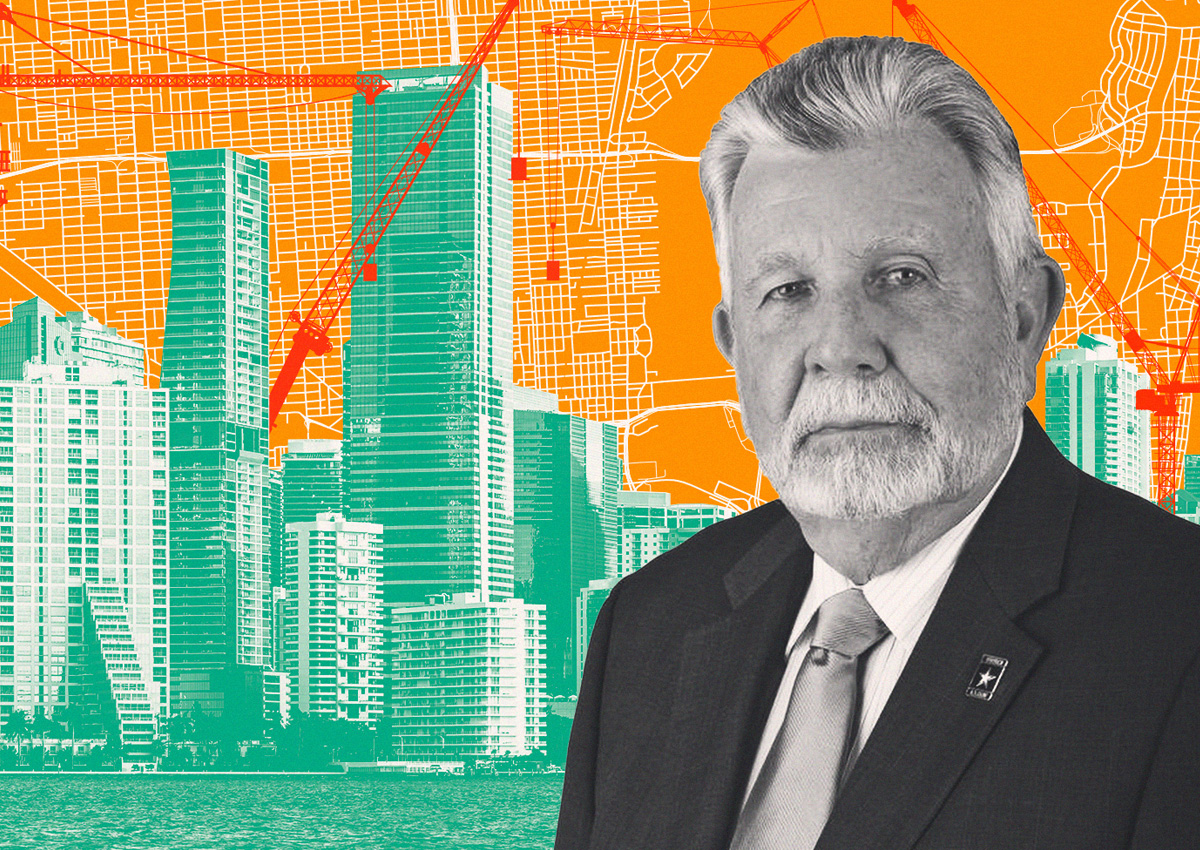

The preliminary value of taxable properties countywide totals $425.8 billion in 2023, according to the office of Miami-Dade County property appraiser Pedro Garcia. Compared with 2022, the annual growth rate is 12.7%.

New construction increased by $6.0 billion, with the city of Miami recording the largest increase of more than $1.5 billion. These include the Downtown Miami Development Authority, which uses a slightly different mileage rate.

Neighborhoods and cities that saw taxable property values increase more than 15 percent this year include Normandy Shores, North Miami Beach, Homestead, Bay Harbor Islands, Florida City, Biscayne Park, El Portal, Golden Sands, Medley, Sweetwater, Hialeah Gardens and Sunny Isles Beach.

In Medley, a major industrial town, taxable values soared 62 per cent to nearly $5.2 billion. Medley also absorbed more than $1.4 billion in new construction.

Normandy Shores, which is part of the city of Miami Beach but is under the jurisdiction of a separate tax agency, jumped 28.6 percent in taxable value to about $393 million. Home prices in Miami Beach increased 10.8 percent to $51.6 billion, with approximately $214 million in new construction.

Garcia urged municipalities to consider reducing tax rates to improve affordability. This week, Miami-Dade County Mayor Daniella Levine Cava proposed a 1 percent cut to property taxes as part of her proposed budget for next fiscal year.