This summer is set to be one of the hottest on record, but a cold front is hitting multifamily real estate.

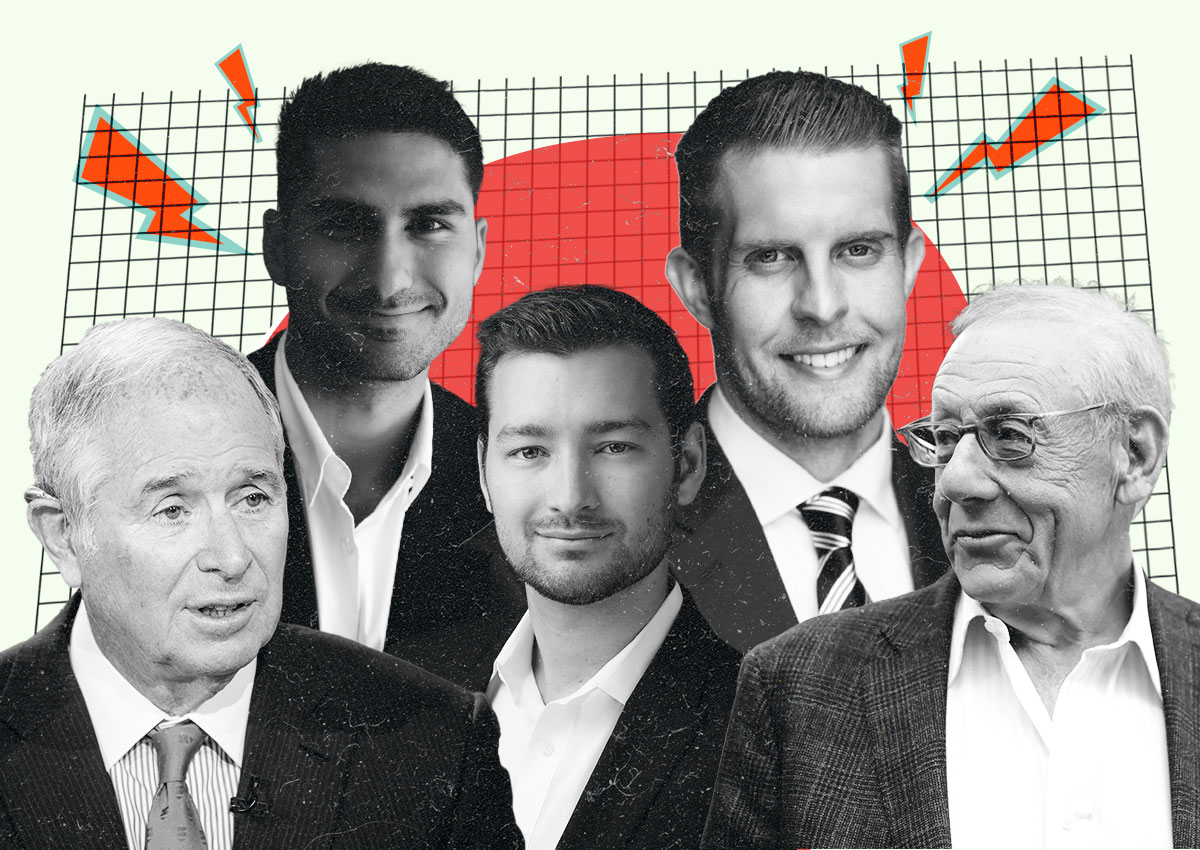

Earlier this week, in response to real dealFounder Zach Haptonstall recorded a 16-minute video of Rise48 Equity’s easy troubles in the multifamily housing space in an article video Tell investors “we’re not distressed” seven times.

But on a median basis, income from Rise48 properties covers only half of the debt payments, Morningstar data show, and renovations at one property that needed an upgrade to boost rental income have been delayed.

Judging from the reaction on the Internet, the video did not attract too many people’s attention.

“Who suggested they respond?” wrote one reader on the investment bank’s website Wall Street Oasis. “These guys are on the watch list right now with multiple loans … I want those 16 minutes.”

Another syndicate, Tides Equities, is also feeling the pinch, but may have found a lifeline in AMC.

The company has made a massive bet of $322 million on Tides through deals over the past five years, buying stakes in 45 multifamily properties acquired by the consortium — as of December, according to a written investment filing. More than 10,000 sets.Obtained by AMC and by TRD.

On AMC’s website last month, the company listed 51 Tides-related properties, but has since removed all references to the company.

None of the properties in which AMC invests is on servicer watch lists, according to one firm. TRD Morningstar credit data analysis. But last month, Tidal sent a letter to investors telling them it was facing cash issues and that they should receive cash notifications in the future. Debt payments on its properties have soared as the company often uses floating-rate loans for acquisitions.

The brutal summer has also brought losses to other players, including related companies and major players such as Blackstone.

In fact, Related’s residential projects may have seen some recent deals at Hudson Yards, but at deep discounts; the success of big developments in the Far West hides a lot of inventory.

Low residential sales at the developer’s 15 and 35 Hudson Yards apartment buildings left the company with more than $1 billion worth of apartments left for sale, according to the analysis. wall street journal.

More than four years after the sale of the luxury 35 Hudson Yards tower, about 50 percent of the units remain unsold.

Meanwhile, Blackstone has listed a large industrial portfolio through its subsidiary Link Logistics with Jones Lang LaSalle (JLL). The six properties in the plan — five buildings and an infill parking lot — are located in and around New York City, including two near LaGuardia Airport, two on Long Island, one near JFK and one is located in Inwood.

The portfolio totals 929,000 square feet and is fully leased, with one tenant per property, according to the listing. The weighted average remaining lease term is just over six years.