Investors in the Nightingale estate project finally have answers about the fate of their funds. This is not the answer they were hoping for.

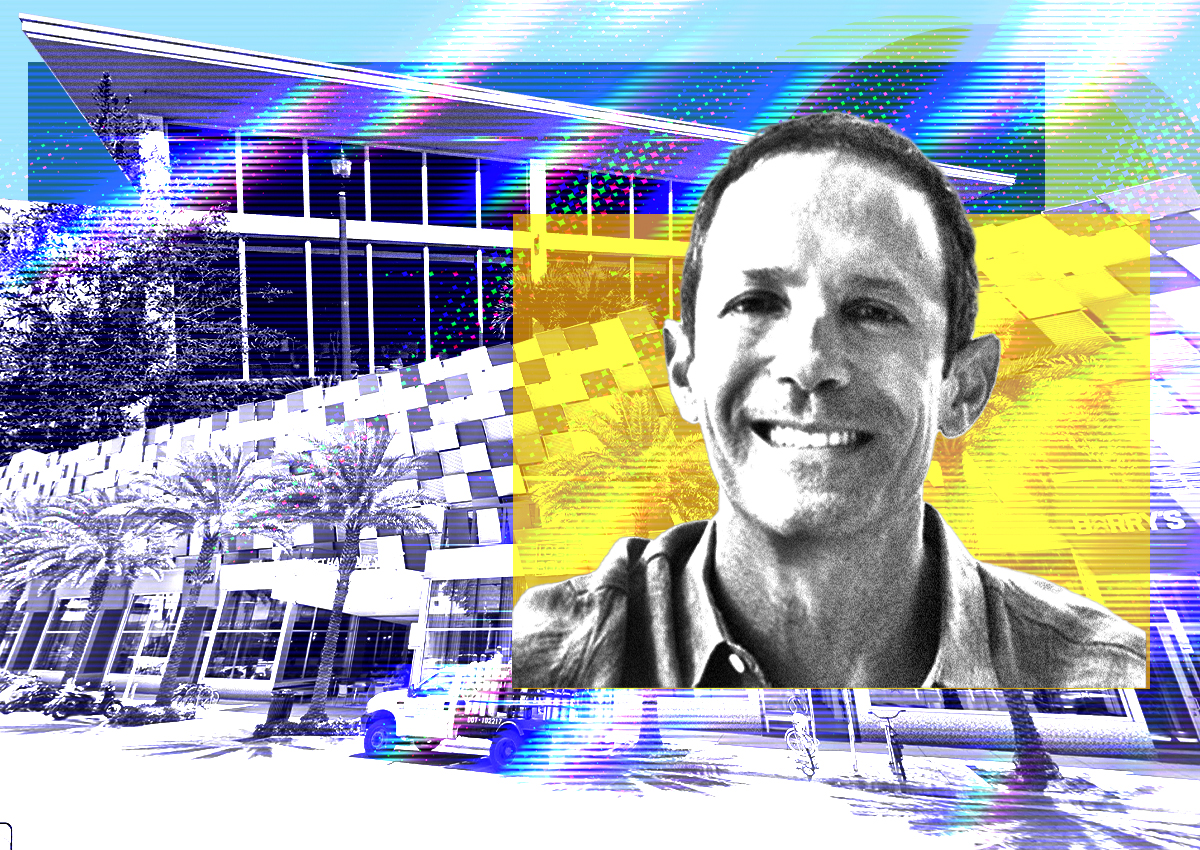

Nightingale raised more than $54 million from more than 650 investors through a crowdfunding platform called CrowdStreet to acquire the Atlanta Financial Center office tower. It also used the platform to raise $9 million from 167 investors in an eight-story office building in Miami Beach. Both deals have not yet been completed.

In a webinar on Friday, Anna Phillips, who was named an independent manager and trustee by investors last month, laid out what she knows so far.

“The bottom line is that the funds raised by both entities were misappropriated,” Phillips said.

Entities linked to the Atlanta financial center had only $125,000 in their bank accounts, and their Miami Beach real estate accounts were similarly empty, Phillips said.

in a statement real dealsaid Claude Streeter “[Nightingale principal] Eli Schwartz and Nightingale blatantly disregarded legal, moral and moral standards,” while also violating operating agreements with investors.

After raising money from investors, most of the money was transferred to Schwartz and his affiliates almost immediately, Phillips said in the webinar. For the Miami Beach property, approximately $3.75 million was transferred to unidentified third parties, with the balance appearing to have been transferred to Schwartz’s affiliates.

“The transfers from this account have occurred on a regular basis and are in direct violation of the agreement with CrowdStreet,” Phillips said.

At the Atlanta property, about $8 million to $9 million was repaid to investors, while about $8 million was transferred to unidentified third parties, Phillips said. The remaining balance appears to have been transferred directly to Schwartz to other affiliates related to Schwartz, she said.

Nightingale agreed last summer to buy the 1 million-square-foot property at 5531 Roswell Road for $182 million, but the deal never closed.

Phillips said she hired legal counsel and filed the two entities under Chapter 11 of Delaware bankruptcy law. She said she hoped the move would put pressure on Schwartz and Nightingale to provide more information about where the money went.

Phillips said he had called Schwartz’s attorneys, but they were unable to reach Schwartz directly. She added that she does not yet have books and records, only bank reporting information.

Nightingale declined to comment.on Reddit Crowdstreet Reddit subredditCommenters have been discussing the webinar since Friday afternoon, expressing hope that auditors will resolve the mess.

Some of Nightingale’s properties in New York City are also facing trouble. The company is foreclosing on the Whale Building in Sunset Park and the Soho office building at 300 Lafayette Street.