An impasse between developers and construction unions over worker wages has stalled talks to restore the 421a mini-property tax cut — just as it did when the last tax cut expired.

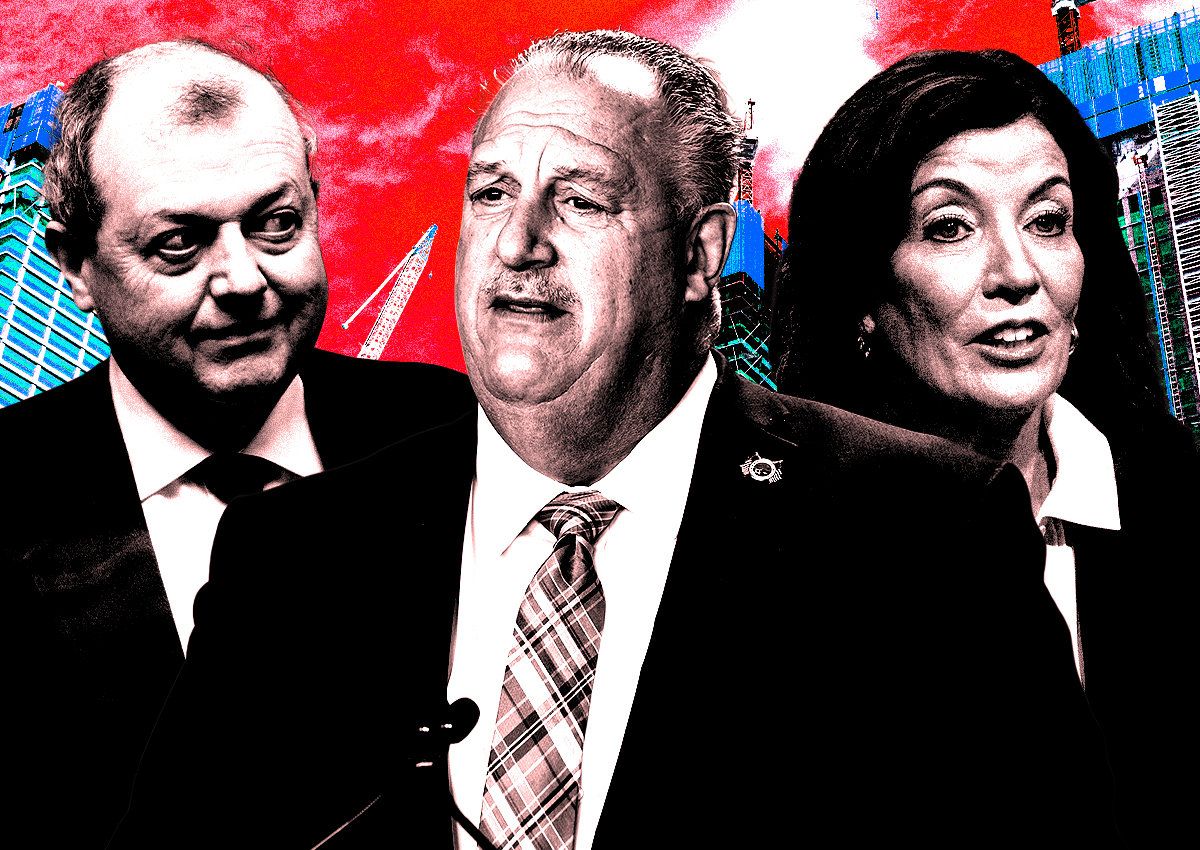

Gov. Kathy Hochul is considering an alternative route to the benefit for certain projects after failing to get the Legislature to agree to extend the construction deadline for tax credits. But the Real Estate Board of New York and the Construction Trades Council disagree on construction wage requirements for such projects.

Due to the political nature of the issue, an alternative is unlikely to be pursued if the two groups cannot agree on terms.

as real deal It had previously been reported that officials were considering a payment in lieu of tax (PILOT) measure. Under this arrangement, the state would take over the property and then lease it back to the developer through a long-term land lease. Rents would be lower than the property taxes developers pay, essentially replacing the benefits 421a once provided.

“Real estate seems less willing to make small compromises to realize this idea.”

While it doesn’t need to be passed by the state legislature, the plan must go through the Public Authority Control Committee, in which parliamentary and senate leaders have a say. Neither was a fan of confronting construction unions.

To qualify for 421a, developers need to lay the groundwork by June 15, 2022 and complete projects by June 15, 2026, but developers believe many projects will not meet that deadline, resulting in tens of thousands of The planned housing units could not be completed. not built.

A source familiar with the discussions told TRD The governor has asked the construction industry about potential alternative pathways to these projects. Organized labor wants changes to the 421a wage requirements, specifically removing geographic restrictions and how wages are calculated.

The 421a alternative was put on hold for 15 months when it expired in 2016 due to salary issues. Ultimately, the parties agreed to raise wages for projects with more than 300 units south of 96th Street in Manhattan or on the waterfront in Brooklyn and Queens. But REBNY and BCTC were unable to agree on changes to save projects that could miss construction deadlines.

“Real estates seem less willing to make small compromises to realize this idea,” the source said.

Another source said the union wanted a “master wage” that would apply citywide and set an average or flat rate for specific industries. According to sources, this will increase project labor costs by 20%.

The BCTC, the umbrella organization for construction unions, and the governor’s office did not respond to requests for comment.

Asked about the proposal and the state of negotiations with the union, REBNY President Jim Whelan said in a statement that the group is “committed to continuing to work with construction unions to help address New York’s worsening housing supply crisis and increase the union construction market.” “Share in an economically sound way. “

new york focus first reported Discussions on extending tax breaks have stalled over construction wages.

Prior to the 2017 421a update, BCTC sought prevailing wages for all 421a items. Then-government Andrew Cuomo insisted that a final deal must be accepted by the trade committee. Ultimately, the labor group and REBNY agreed on a wage floor for large projects in specific areas.

Since that version of the property tax break expired last year, project applications have fallen sharply.

The fight to change these wage rules predates the pilot-based proposal. When the Governor proposed extending the 421a completion deadline by four years, the NYC Carpenters District Board requested an increase to the prevailing wage requirement.

read more

But the impasse also hurts unions, because a project that isn’t built won’t pay any wages at all.

“It’s disappointing that these two groups, labor and the real estate industry, haven’t been able to reach some sort of resolution,” said Brett Gottlieb, a partner in Herrick’s real estate division.