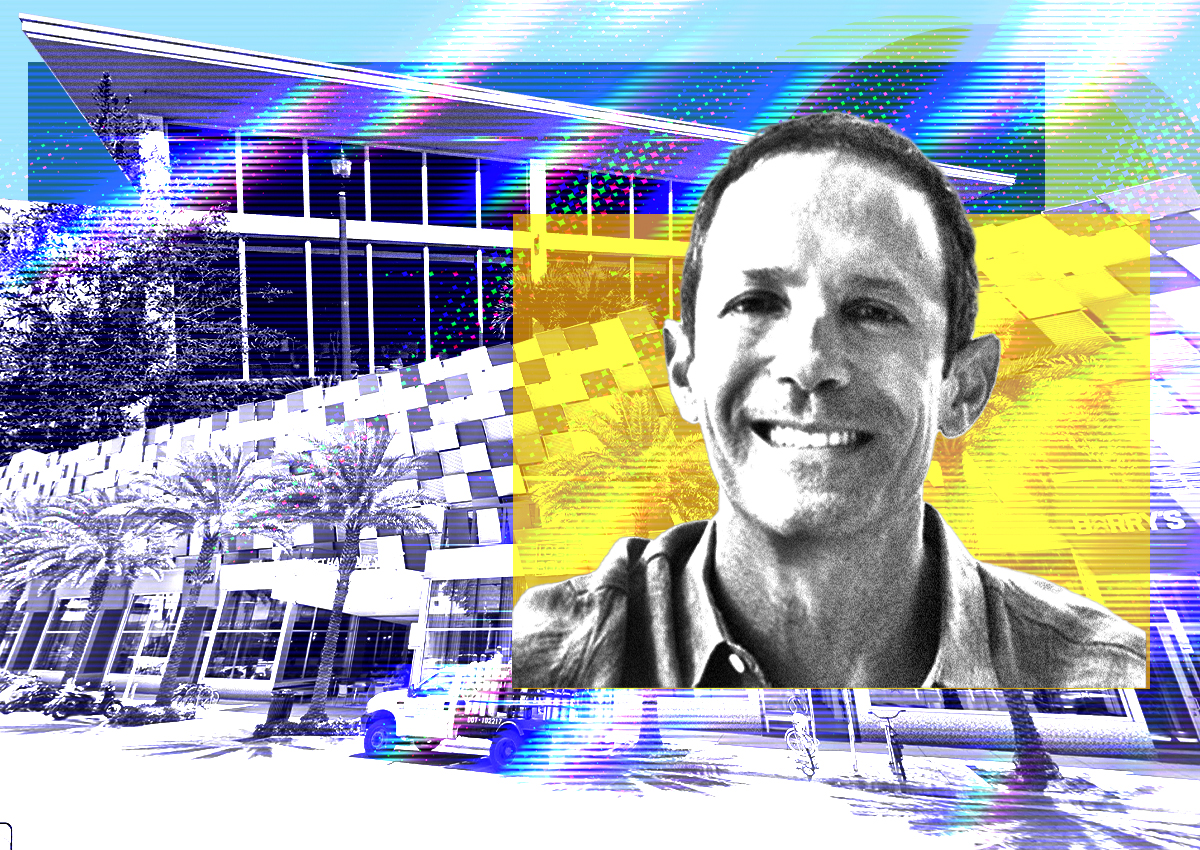

State Street Corporation defaulted on an $81 million loan related to an office building in Irvine and failed to make full repayments when it was due in March, real deal Already learned.

The Boston-based investment manager holds two loans, one for $45 million and the other for $36 million, on the 893,000-square-foot complex at 18101 Von Karman Boulevard, according to Trepp. Loans are in default. Both loans were originated by Starwood REIT, which were then packaged into commercial mortgage-backed securities transactions and sold to investors.

Neither State Street nor Starwood responded to requests for comment.

State Street holds a total of $195 million in CMBS loans tied to the property, called Lakeshore Towers, according to Morningstar Credit.

Borrowers missed payments in May and June, according to Morningstar. The loans originally matured in March, but State Street extended their terms by 60 days.

In May, State Street lost its WeWork tenant, the third-largest tenant in the 879,000-square-foot complex. The co-working company, which is battling massive losses and a plunging stock price, exited the complex’s 75,000 square feet of office space. WeWork’s lease was due to expire in 2034, according to Trepp’s data.

The landlord did get a lifeline last year when the First Foundation renewed its lease on 70,200 square feet of the office building.

State Street inherited the leasehold interest in the office building when it bought General Electric Asset Management in 2016 for as much as $485 million. GE’s pension fund purchased the leasehold interest in the property in the early 1990s in partnership with Irvine-based MBK Real Estate.

History appears to be repeating itself on this property. In 1996, GE’s pension trust fund and MBK applied for bankruptcy The building was investigated after failing to repay the loan.