Soaring interest rates, the shift to remote and hybrid work, and negative momentum from inflation are causing some real estate businesses to struggle.

The situation this week cannot be ignored.

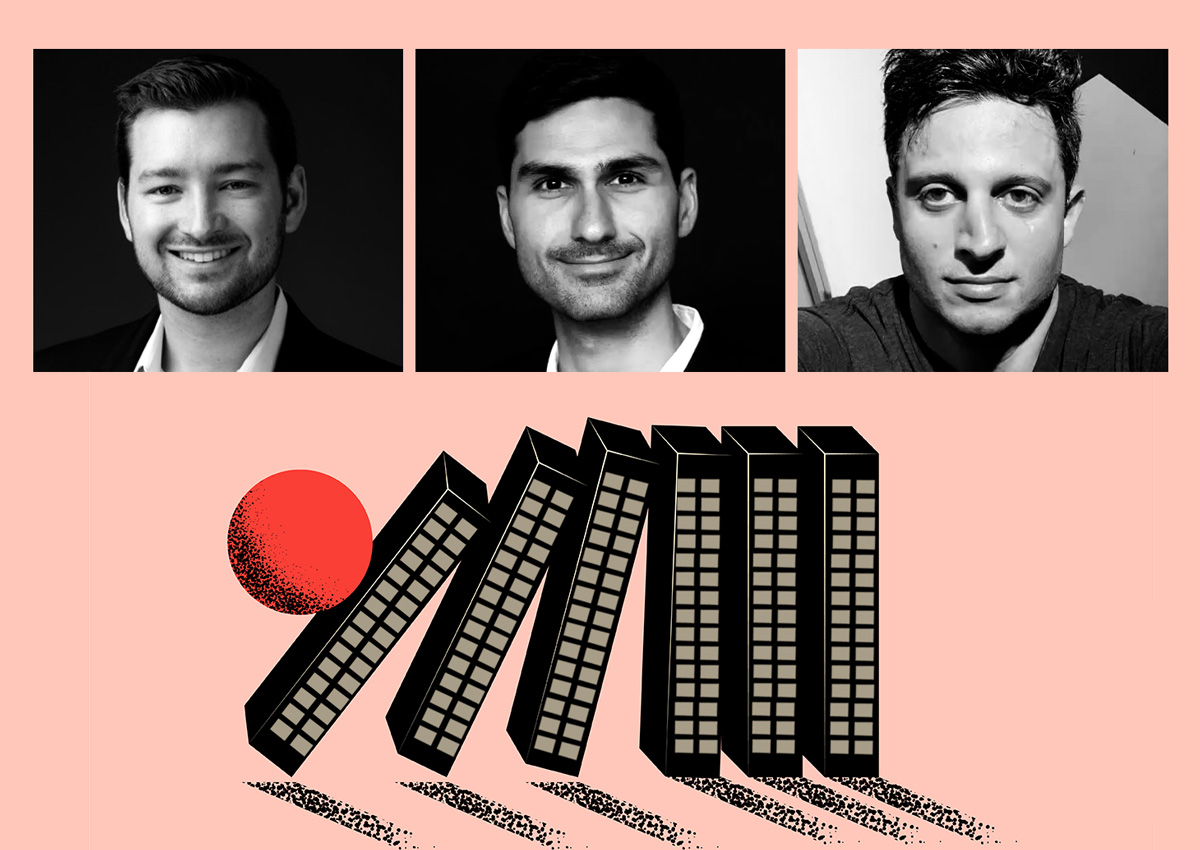

With interest rates rising sharply, Tides Equities co-founders Sean Kia and Ryan Andrade tell investors to expect capital needs (limited partner capital injections) to help shore up portfolios .

The Los Angeles-based investment firm emerged as one of the most aggressive multifamily buyers in 2021 and 2022, snapping up more than $6.5 billion worth of condos in the Sunbelt market, some of them in double digits over the period. rent increase.

But almost all of those acquisitions were made using floating-rate loans during a period of low interest rates. As interest rates rise, debt payments skyrocket.

Also on the West Coast, Umpqua Bank, based in Lake Oswego, Oregon, said it would close its multifamily division and “will wind down” loan production on the West Coast.

“We will continue to offer loans in multifamily asset classes to relationship-based borrowers, typically borrowers with deposits, financial management and other services at the bank,” a Umpqua Bank spokesman said in an email.

The condo loan exit comes after the collapse of First Republic, leaving a loophole for those with business around the asset class.

Umpqua Bank is also known for offering construction loans that are on-maturity mini perpetual loans, which are short-term loans that typically have a longer term than bridge financing.

These aren’t the only bad news for Golden State. Orange County home prices are expected to drop more than 10 percent this year.

With local home prices falling 11% over the next six months, the OC economy will struggle along with the nation, According to the Orange County Registerciting a Chapman University economist.

On the East Coast, Richard Ohebshalom of 54 Thompson Street in Soho, New York, lost control of a seven-story building that included an apartment he lived in after defaulting on a loan .

Ohebshalom committed title to the property, which was transferred to lender SME Capital Ventures in a July auction, as collateral for a $4 million mezzanine loan, according to a public auction notice and documents reviewed. The real deal.

The loss comes as Ohebshalom faces other difficulties, including other lawsuits against the Soho property and the appointment of a receiver In May, he was in a 103-unit rental building in downtown Brooklyn.

Elsewhere, SL Green sold a stake in 245 Park Avenue to Japanese developer Mori Trust in the largest office sale since Federal Reserve rate hikes froze the commercial real estate market, in a deal that valued the building at $2 billion.

It’s a major breakthrough for the city’s office market, offering price discovery for investors trying to figure out how to value office properties in an era of mixed jobs and high borrowing costs.

The $2 billion implied price is in line with the valuation SL Green offered when it bought the bankrupt 1960s building in September. Its previous owner, China’s HNA Group, bought the tower in 2017 for $2.2 billion.

Buy prices are capped at just over $3, which could spill over into the market as buyers and sellers try to narrow the bid-ask spread.

It turns out that difficult times for some are opportunities for others.

Bargain hunter Empire Capital continues its Manhattan office spree, most recently buying 529 Fifth Avenue from Silverstein Properties for $107.5 million. Empire received a $71.5 million loan from Deutsche Bank, according to people familiar with the matter. Retail magnate Igal Namdar of Namdar Realty was also part of the buyer group.

The firm of Josh Rahmani and Ebi Khalili is one of the few office buyers in New York City who are betting they can get the properties at a discount. Deals by these former brokers and their companies often involved prominent members of Great Neck’s well-connected Persian real estate community, including the Namdar and Hakimian families.