This week, all roads lead to South Florida — or at least its courts.

While not every big story comes out of legal wrangling in the Sunshine State, there’s always a sense of it.

Real estate developer Donald Trump was arraigned Tuesday in Miami on 37 felony counts related to alleged mishandling of classified documents. He pleaded not guilty.

As he said earlier this year in New York following allegations he made hush money payments to a former porn star ahead of the 2016 election, Trump’s legal woes could affect Trump Organization real estate deals. That includes bank financing (the indictment could put Trump in breach of the loan); and problems with government contracts, licensing agreements, or LLC partnerships.

“Depending on how the loan is structured, the loan documents may contain certain covenants and provisions relating to felonies and federal crimes,” Pierre Debbas of Romer Debbas told real deal“For example, he is the guarantor of these loans. … There is likely to be a provision that if he is involved in any federal criminal activity, [the lender] It can be called a loan. “

Trump, the current front-runner for the 2024 Republican presidential nomination, is not the only Florida Republican politician at the center of a legal battle for the White House.

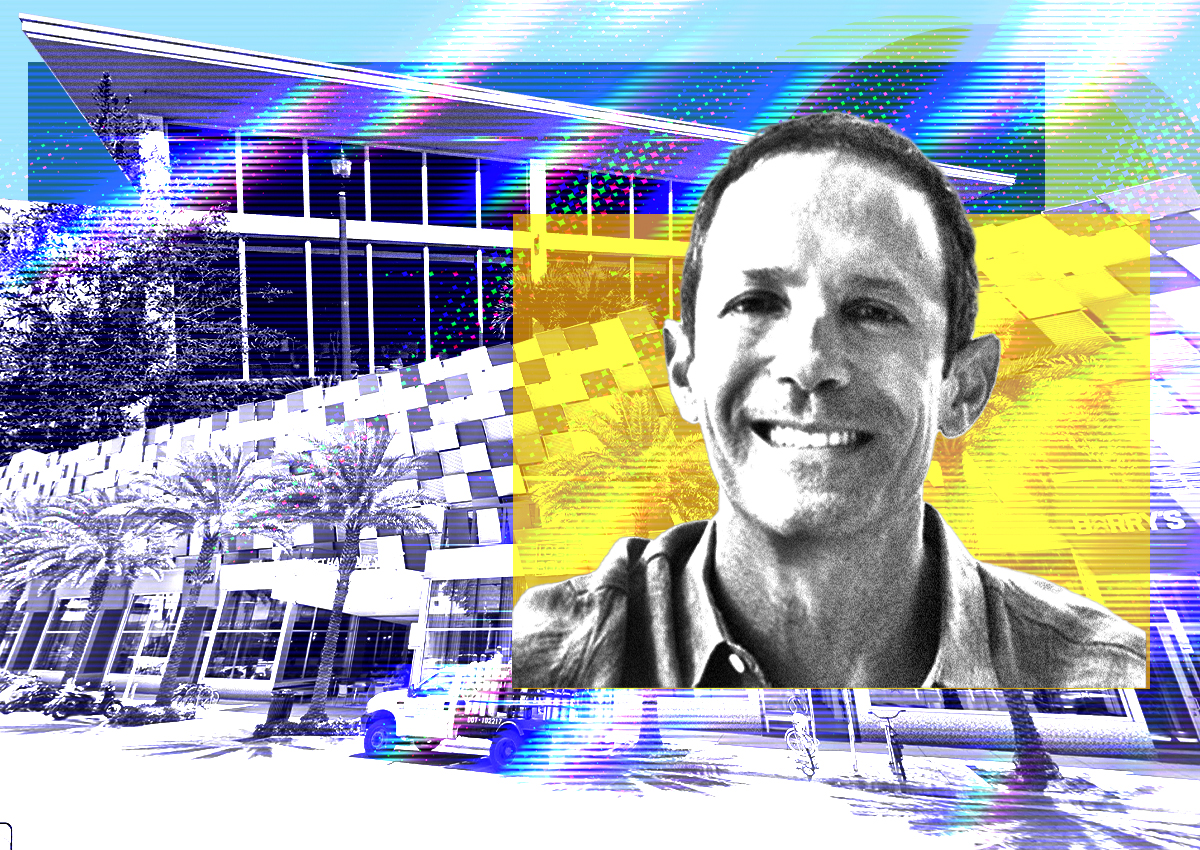

Miami Mayor Francis Suarez, who stormed an already crowded field of Republican presidential contenders last week, is facing state and federal investigations over his receipt of private payments from developer Rishi Kapoor.

Last week, the FBI and the SEC confirmed parallel investigations into Kapoor and his businesses. The FBI’s criminal investigation focuses on $10,000 a month paid to Miami Mayor Francis Suarez by a subsidiary of Kapoor’s company, Location Ventures. The agency is investigating whether the payments amounted to bribes in exchange for a permit or other favor from the mayor for Location Ventures’ mixed-use project in Coconut Grove.

The SEC is also investigating Location Ventures, focusing on whether Kapoor and his company sold investment contracts without registering it as a security, misrepresented potential profits to investors or used the funds for personal expenses. The agency’s investigation, which began earlier this year, is examining potential violations related to securities regulations.

Meanwhile, Patrick Carroll, founder of the Carroll Organization, an Atlanta-based real estate investment firm that owns $7.4 billion in multifamily properties in the U.S., was sued for defamation by a restaurant manager in Wynwood, Miami. , which Carroll allegedly spat on.

In his complaint filed in Miami-Dade Circuit Court, Miguel Angel Weill highlighted two alleged incidents at Carroll’s other South Florida dining establishments frequented by the rich and famous. Carroll was barred from all restaurants owned by New York-based Major Food Group and New York restaurateur Simon Kim, the complaint said.

Among other things, the suit alleges that Carroll called a service manager the “street N-word” while intoxicated after he was asked to leave the Italian restaurant after harassing a waiter.

Finally, while not directly related to the lawsuit, an investigation revealed that flaws in the design and construction of the Champlain Towers South pool deck resulted in an “extremely low failure rate” for that part of the building.

The design did not meet building codes, with “serious” strength deficiencies in slab columns and fixtures in several places on the pool deck, according to the National Institute of Standards and Technology’s findings.

The inquiry was followed by the announcement that the Dubai-based developer who bought the site of the Surfside collapse last summer had submitted plans to build a beachfront luxury apartment tower designed by Zaha Hadid Architects on the property.

Damac Properties, led by Hussain Sajwani, wants to build a 12-story boutique building with 57 units on a 1.8-acre site at 8777 Collins Avenue, according to a company press release.