Just before the pandemic, the timing of Market Street Real Estate Partners’ investment in a West Loop office building couldn’t have been worse. It will end with a giveaway to the Miami-based landlord’s lenders.

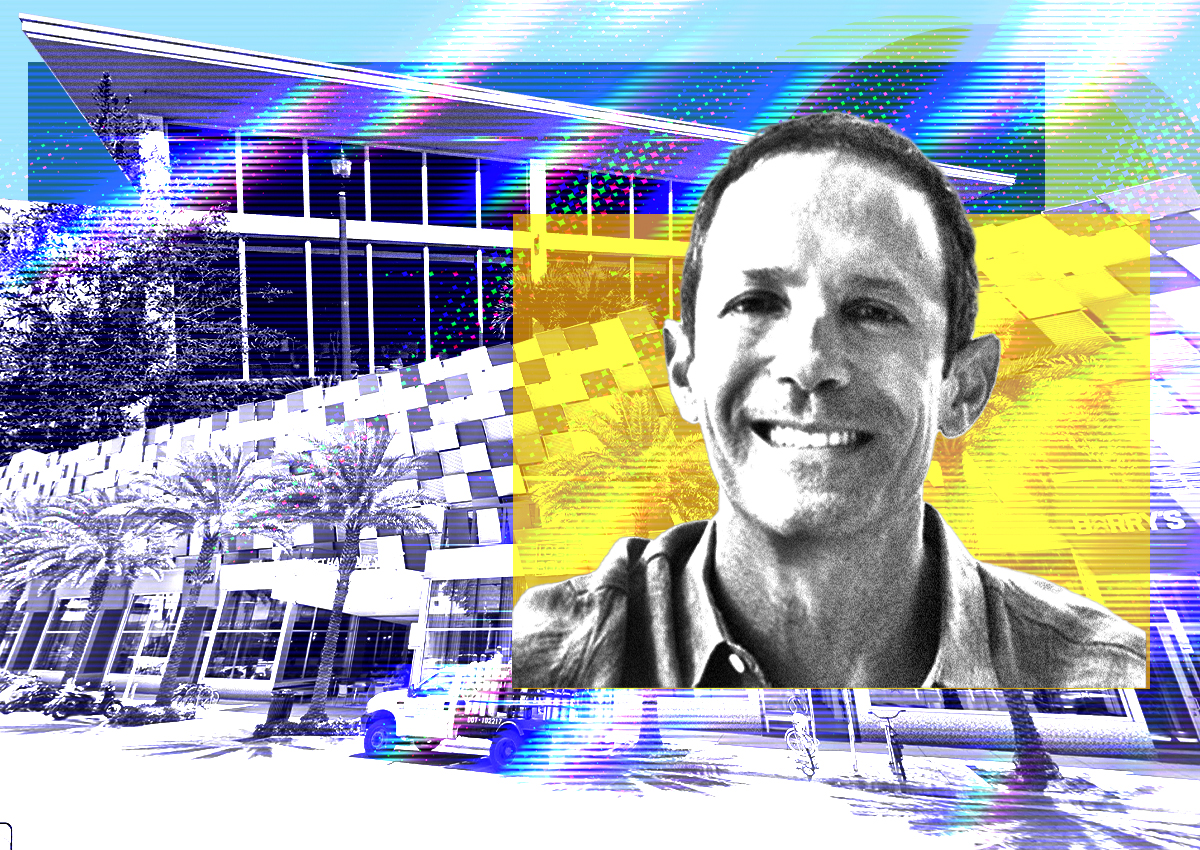

Market Street, led by principal Danny Warman, surrendered the 12-story building at 209 West Jackson Avenue this month through a foreclosure deed in lieu, CoStar ReportACRES Capital, the lender of the $25 million in debt associated with the property, will now take title to the asset while Market Street escapes foreclosure proceedings.

It’s the latest sign of the Chicago office’s woes. The remote work movement, fueled by the pandemic, has already hit office landlords hard. More recently, high interest rates, bank failures, company layoffs and fears of a possible recession have compounded the problem.

As vacancy rates hit record highs in the Windy City last quarter, many homeowners were forced to sell their holdings at deep discounts, return the keys to their lenders, or face foreclosure. Some office building owners spend millions of dollars on renovations to stay competitive, while others undertake office-to-residential conversions or other forms of adaptive reuse.

Even some Grade A office buildings once considered impervious to distress are now facing these challenges.

But demand has plummeted, especially for older Class B and lower-quality buildings, such as Market’s property on Jackson Avenue. The 143,000-square-foot building’s vacancy rate was 26 percent, above the downtown average of about 22 percent in the last quarter.

Three years ago, Market Street refinanced 209 West Jackson with a loan from Uniondale subsidiary ACRES. This replaces a previous loan taken out by the landlord when it purchased the property for $23.5 million in 2018.

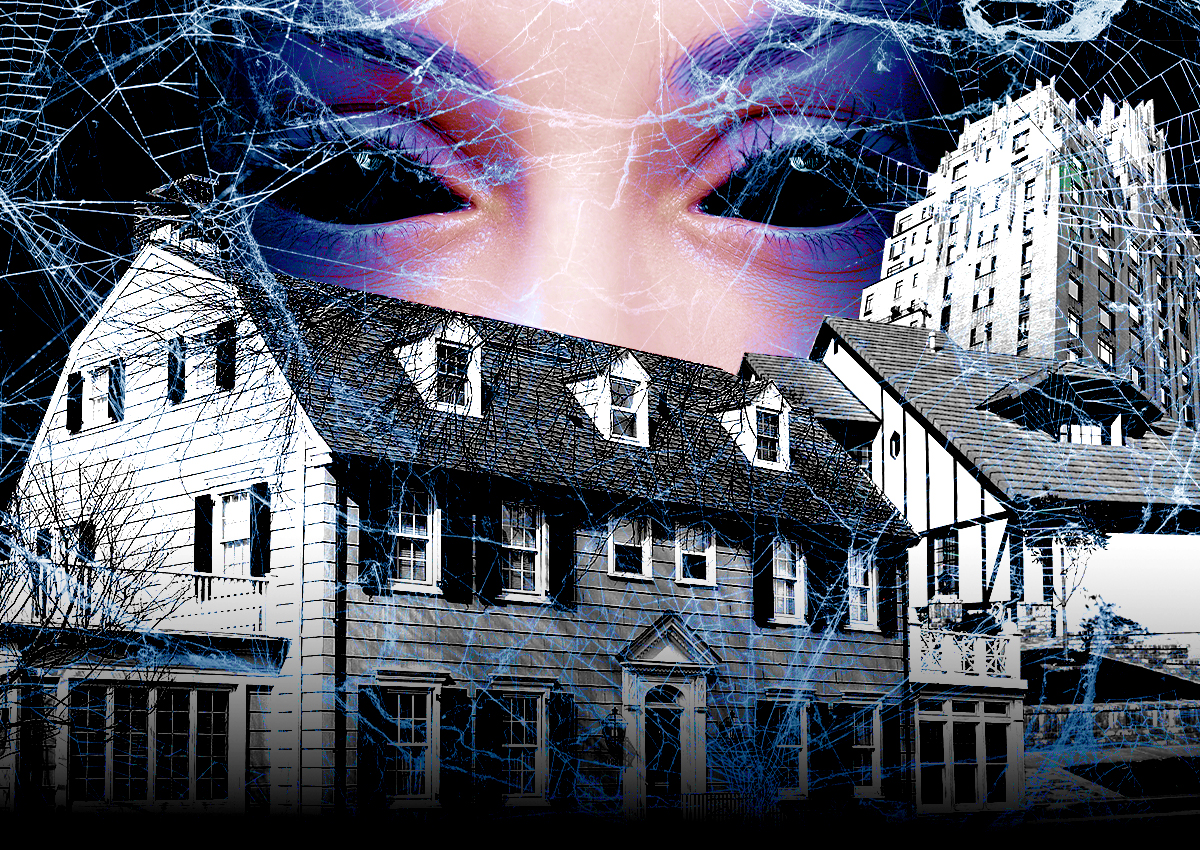

It is unclear how much Market Street still owed ACRES at the time of the lender’s deed-in-substitute acquisition. The lender also seized a 24-story office and retail building at 65 East Wacker Place last year from a borrower who previously owned the building. ACRES then sold it to Intersection Realty Group for $19.25 million, less than the $24.4 million owed to the ACRES joint venture.

Intersection plans to convert part of the Wacker Place building into apartments. It’s unclear whether ACRES will target a sale to a developer with similar goals to the Jackson Boulevard property’s exit strategy.

— Quinn Donoghue