Updated April 27 at 10:15 AM: George Filopolous gave up a building in Greenwich Village, but the troubled loan left behind sparked a bizarre legal battle over the property, which is now being sold as an apartment development site.

The plot begins with The LLC, a longtime real estate investor, was notified in September 2020 that it defaulted on its $9.3 million first mortgage at 307 Sixth Avenue.

LLC – Filopolous says he owns 10% interest, separate from his company Metrovest Equities — Failing to repay the loan by the due date, lender Castellan Capital filed for foreclosure.

Castellan sold the loan in December 2021, according to property records. Filopolous then transferred its interest in the property in May, according to his company’s lawyers. A court document said the transfer occurred in June, but did not say who controls ownership of the LLC. (William Schneider has filed for this entity.)

The judge hearing the case ruled in June that the LLC’s debt had grown to about $15 million. Foreclosure auction scheduled for December 14th.

But on the eve of the auction, another stakeholder went to bankruptcy court to block its passage.

William Rainero’s family Sell Filopolous LLC said in court documents in 2017 that he had provided the buyer with a $5 million mortgage to complete the $17 million deal. The loan came in second, behind the Castellan-originated loan.

Rainero argued that by agreeing to return the property to the lender, the owner was conspiring to eliminate him. The bankruptcy court agreed to delay the sale. Ownership LLC filed its own bankruptcy suit and the property is now being marketed by the Meridian Investment Sales team led by David Schechtman.

Schneider submitted project plan November, a seven-story, 39-unit building with ground-floor retail and community space.

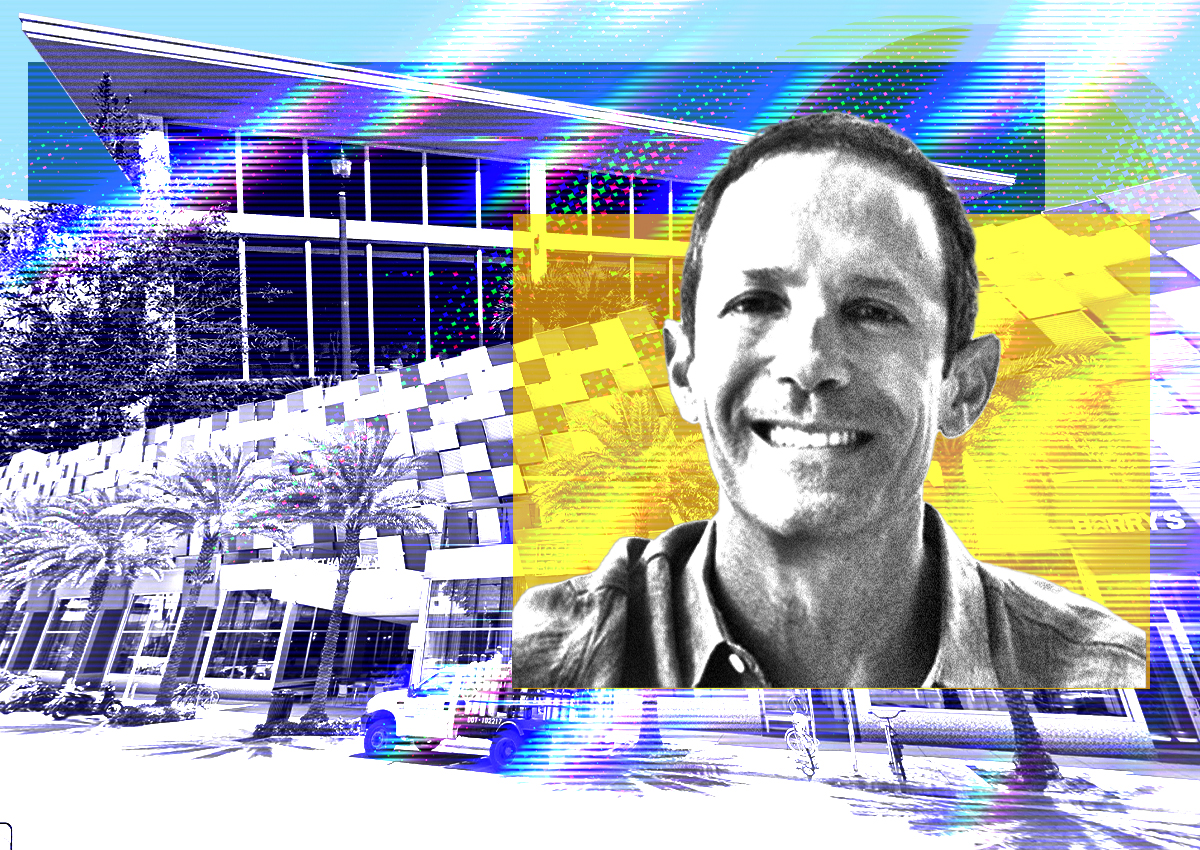

LLC claimed in its January 2023 bankruptcy filing that Filopoulos, who owns the upscale Gurney’s Montauk resort in the Hamptons, recognized that the Greenwich Village development site was underwater and “agreed not to contest the foreclosure and transfer the title to” a partner with his lender. associated entity.

Filopolous disputes that, saying he relinquished his interest in the property after trying to find a retail tenant for it.

this Meanwhile, lawyers for the Renero family say they will enforce their rights in the owners’ bankruptcy case.

“My client, the Rainero family, has owned property in Greenwich Village for over 100 years,” attorney Bruce Bronson wrote in an essay. “They owe $7 million and want to be paid.” When he sold the two-story Sixth Avenue building, the second mortgage became the responsibility of the buyer, Filopolous said.

In court documents, Rainero hinted that the lenders may be paying the LLC’s legal fees to take over the property.

“The debtor’s independence is critical to the proper marketing of the property for the best price,” his lawyers wrote.

This story has been updated with information from attorneys at Castellan Capital, Filopolous and Metrovest to explain the property’s ownership history and senior mortgage.