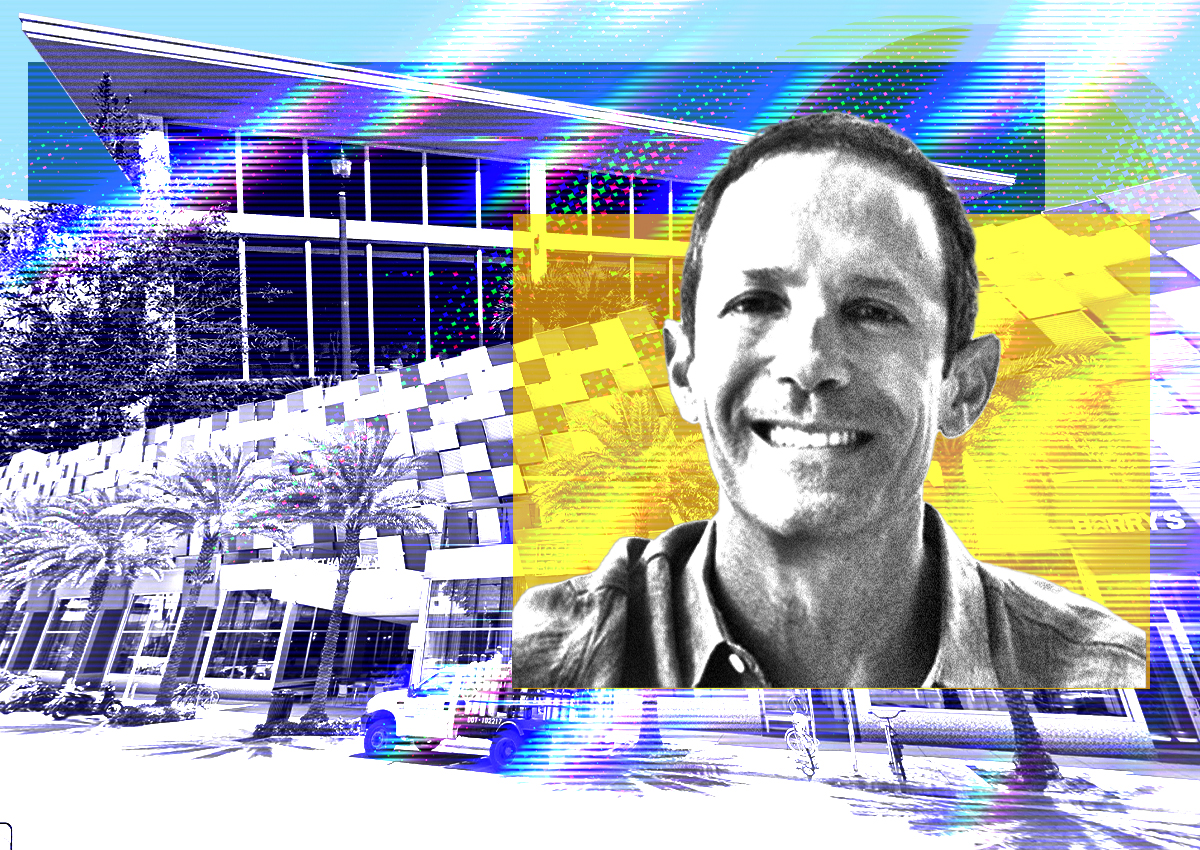

Accesso Partners is failing to pay a loan on an office building in a Chicago suburb, and its lenders fear it may default on other debts tied to commercial properties in the area as market woes escalate.

The landlord defaulted on a $33 million loan for two Highland Oaks office buildings at 320,000 square feet on West 31st Street in Downers Grove, months after the anchor tenant left, according to credit rating agency DBRS Morningstar.

The lenders also added two loans to their watch list related to other Chicago office properties owned by Hallandale Beach, Fla.-based Accesso. Those assets include Park Plaza, a 211,000-square-foot building in Naperville that has an $18 million loan scheduled to mature in November.

According to Morningstar, the Highland Oaks loan was special serviced in March. The space is a quarter smaller when its former largest tenant, the Health Care Service Corporation (parent of insurer Blue Cross Blue Shield), moved late last year to a nearby building at 3500 Lacey Road.

“We continue to work in good faith with Highland Oaks and Park Plaza special servicers and are optimistic about negotiating a mutually beneficial solution,” an Accesso spokesman said in an email Tuesday. Special service agency Midland Loan Services did not Responding to a request for comment.

As the drumbeat of suburban office woes keeps beating, it’s becoming a familiar storyline. Also in Chicago’s west suburbs, Philadelphia-based Rubenstein Partners defaulted on $85 million in loans on three Continental Towers, and a venture led by Chicago real estate investor Chet Balder will return the keys to the Rolling Meadows property to lenders for $23 million. debt. Additionally, Canadian landlord Adventus Realty Trust, which owns a large office stake in Chicago, could be at risk of losing a large portion of its portfolio.

According to the servicer’s September report, Accesso is “actively conducting leasing efforts to find new tenants” to fill the vacant Highlands Oaks space, and is investigating options for improving amenities and repositioning the buildings, which were built in the early 1980s and renovated in 1990. method.

Accesso has also been hit by a tenant leaving two other office properties in its suburb, as Highland Oaks lending entered troubling financial territory. Tyson’s $68 million loan for a building in the Esplanade complex, also in Downers Grove, was put on watch by lenders after Tyson opted not to renew the lease when it expired in 2021. The food processing company previously occupied 12 percent of Accesso’s 609,000-square-foot Esplanade property.

read more

In March, a lender made the same move, putting a loan on Accesso’s Park Plaza property in Naperville on watch, also due to occupancy declines since the deal was initiated, Morningstar reported. So far, it’s unclear whether the loans have the potential to sour Accesso or its lenders’ prospects for the Chicagoland assets.

Accesso reportedly told loan servicers that the pandemic has significantly reduced demand across the market over the past two years, and that while rents have remained resilient, concession packages have been fattened, benefiting tenants at the cost of landlords.